Retail is in the eye of a ‘perfect storm’. As we exit the global pandemic, the much awaited upturn in sales combines with an unprecedented level of supply chain challenges. This has forced retailers to focus heavily on inventory management and particularly on unproductive stock.

In this article, we explore the contributing factors to the current situation, what it means for retailers’ inventory management strategies, and the benefits for those who can ride out the storm and keep their retail ship on an even keel.

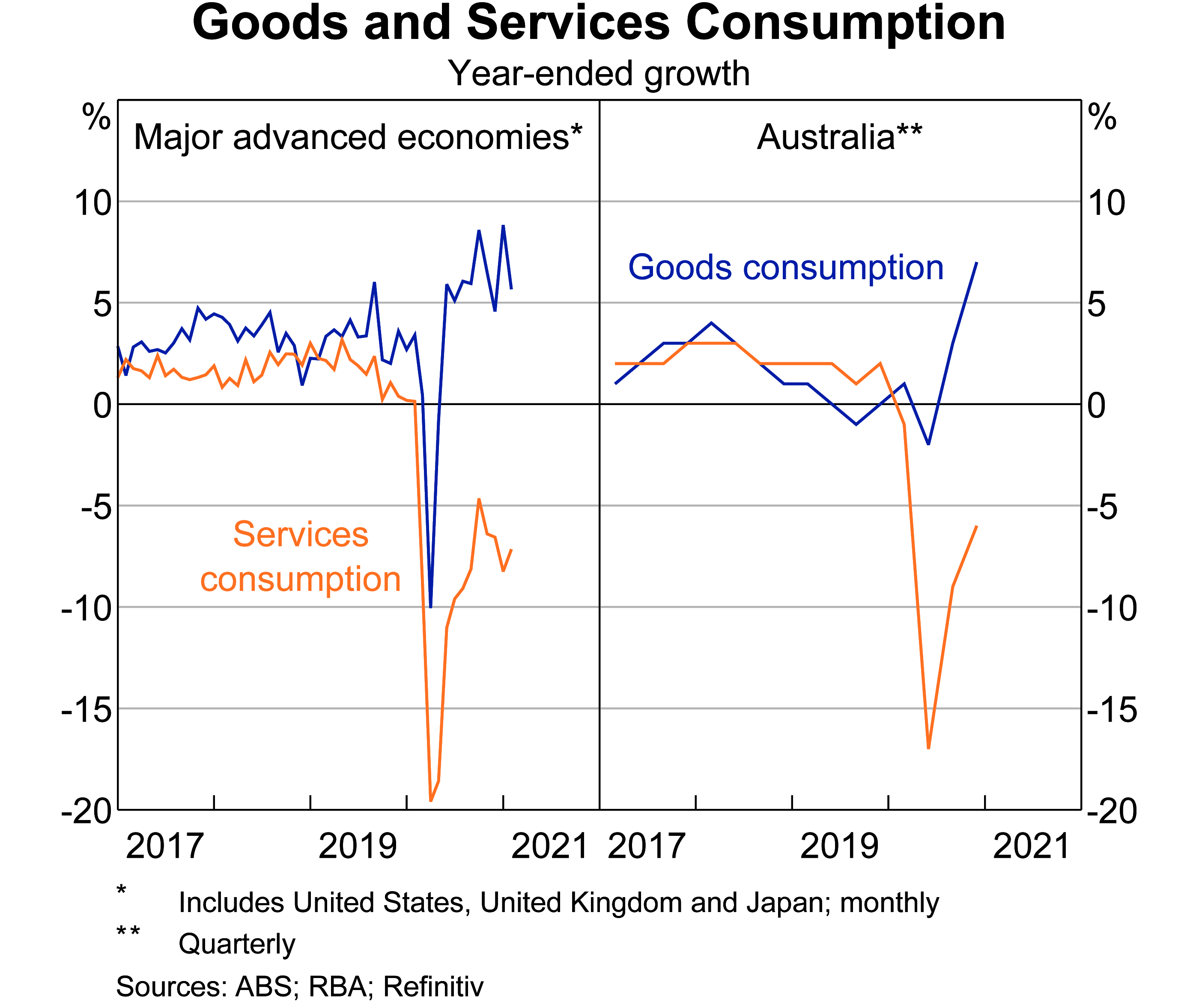

As stores around the world re-open open for business, consumer spending on goods is, not surprisingly, on the increase, counter-balancing the downward dive in services consumption. Australia, having had one of the world’s toughest lockdowns, is part of this global upwards goods trend. Recently released figures from the Australian Bureau of Statistics (ABS) show increases across all categories, with household goods leading the pack with a 3.4% upturn.

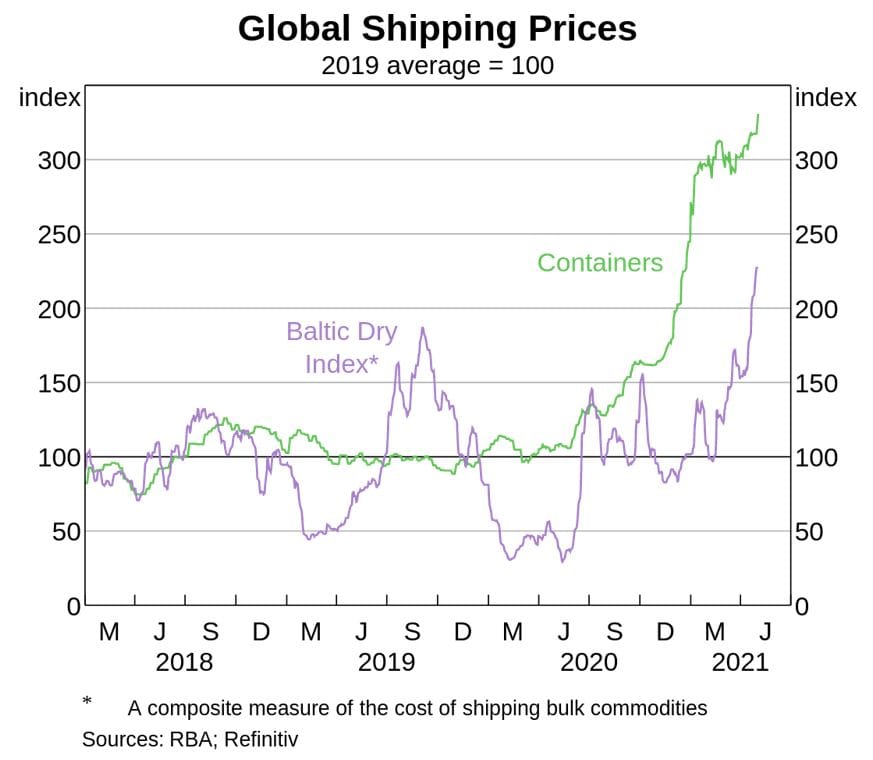

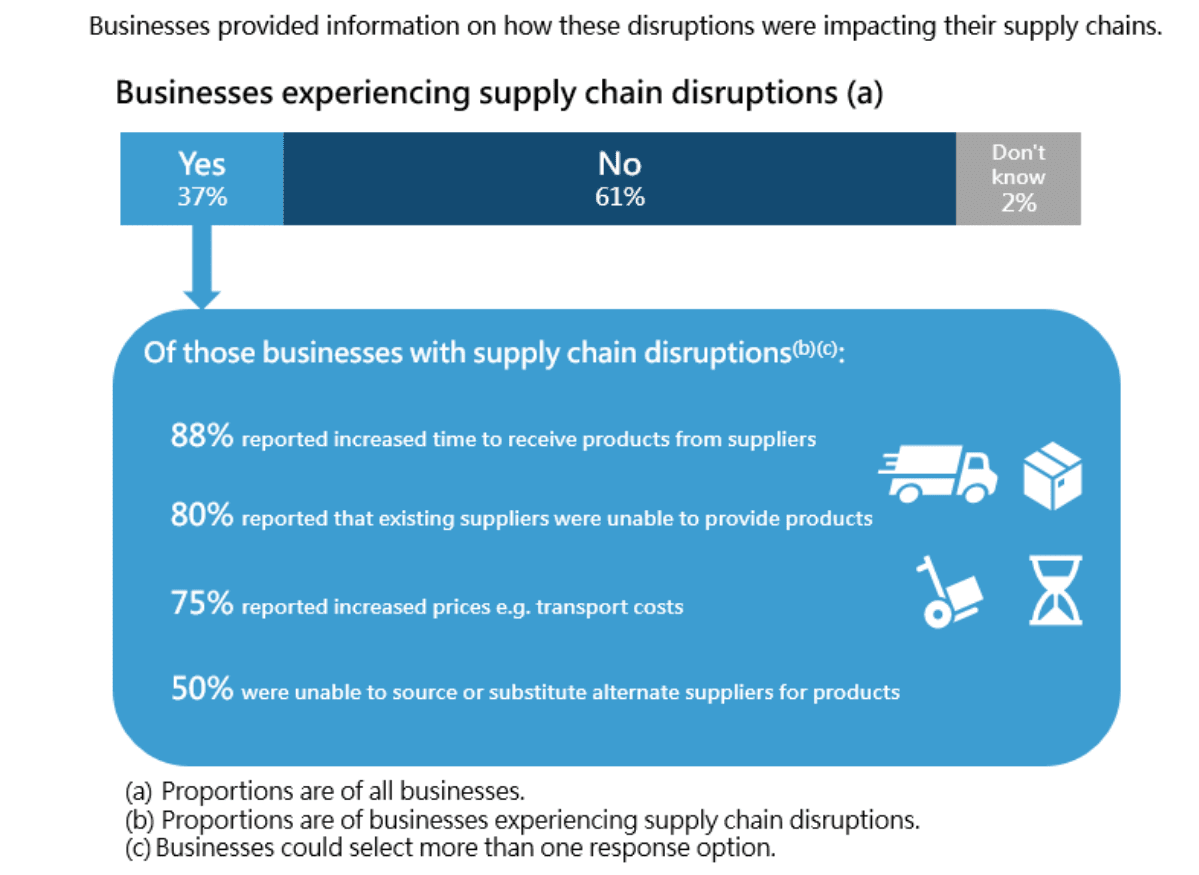

At the same time, freight costs have skyrocketed. Driven by logistical challenges – insufficiency of containers, containers not in the right places after the pandemic – and now further exacerbated by the rise in fuel costs, global shipping costs have increased dramatically since 2019. Add the fact that the shift in consumption patterns took suppliers by surprise, giving the logistics industry little time to react, and it’s not hard to see why transportation has become major influencer of supply chain issues.

The third factor is the scarcity of warehousing space and the related cost increase. According to research from CBRE, warehouse vacancy rates are as low as 0.3%, and industrial rents rose by a record 6.6% annually in Quarter 1 of 2022, leading to a warehousing ‘double whammy’.

People are an essential element of the supply chain, and they are leaving the sector in their droves. The Great Resignation of 2021, which saw hundreds of thousands of workers around the globe leave their jobs, impacted the retail and logistics sectors more than just about any other. The shortage of staff in a time of increased sales only exacerbates rising costs.

For some retailers, the pandemic lockdowns and travel bans, implemented with virtually no notice, left them high and dry with stock on their hands that they couldn’t shift. A duty free retailer, for example, with high turnover technology stock, found itself with very few customers, and products which, by the time lockdowns ended, were virtually obsolete.

For retailers, this perfect storm presents a conundrum. How do they find the right balance between the pressure to increase inventory holdings to meet rising sales demand, and needing to mitigate increased shipping and storage costs? How do they navigate the supply chain disruptions that look to continue for the foreseeable future? How do they keep their customers happy by having the right stock, and their shareholders and investors happy by not having too much, or unproductive stock? The perfect storm situation impacts the balance sheet and P&L, and inventory is therefore more of a focus than ever for CFOs and Leaders.

The impact on category managers and supply chain specialists has been to force a change in practices and ranging strategies. With less space available, and then only at premium prices, companies need to get on top of their inventory management practices and ensure that real estate is being optimally used.

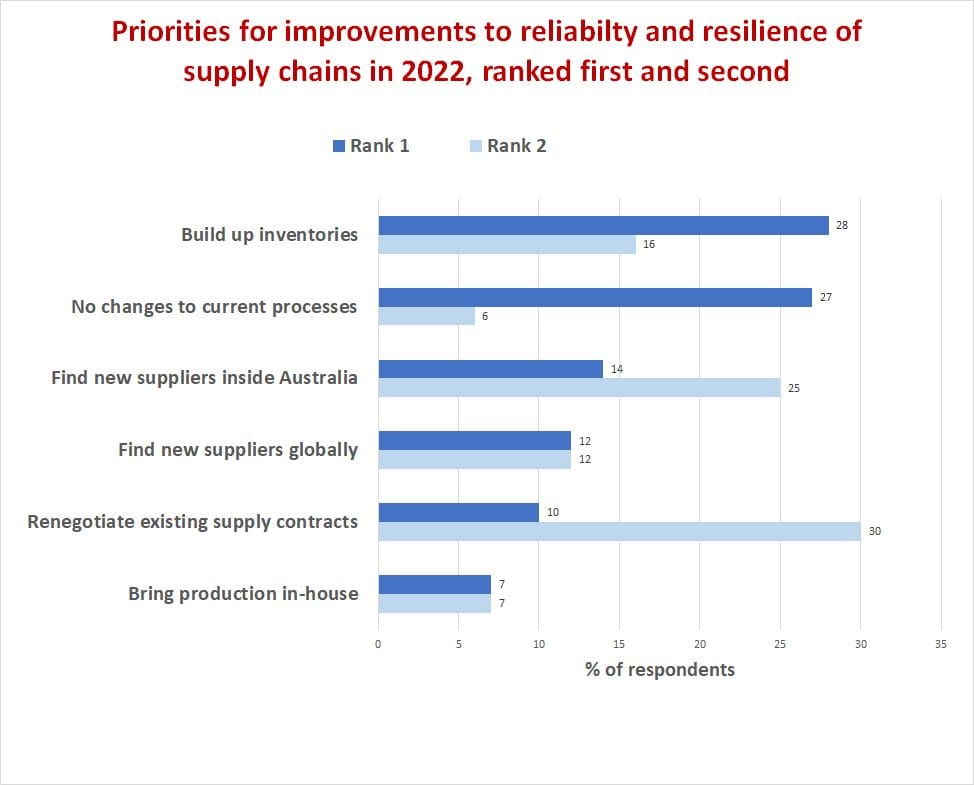

The increase in sales, combined with supply chain disruptions means that for many retailers, the top priority is to build up their inventory. A recent survey of Australian CEOs by Australian Industry Group indicated that building up inventory was the major supply chain focus in building resilience in their business in 2022.

But freight and warehouse costs mean that the question turns to how to ensure the right inventory is being held. This most definitely appears to be a reversal of a long held buying trend in which companies tried to shrink their turnaround times to be more responsive to trends and cut down on excess inventory.

In particular, retailers are looking at:

Core vs seasonal goods – Retailers are shifting the balance and favouring core products that they know will turn over productively, over large volumes of seasonal goods. They are still smarting from the shift of spending in 20-21, which saw them unable to fulfil customer orders of core ranges, whilst at the same time seasonal stock took up more space than ever.

Activewear retailer Lululemon has felt the effects of being in an under-inventory position with an increased cost base due to reliance on air freight to supplement stock levels. In their recent earnings call, CFO Meghan Frank announced their decision to increase holds of seasonless products to manage their inventory moving forward to fulfil ongoing and future demand. More targeted buying and ranging strategies may see a rationalisation of core ranges, and the need to find secondary channels to sell through excess or unproductive stock without creating a cannibalisation effect.

Ranging strategies – retailers are rationalising and reducing the extent of core and seasonal ranges. Where companies could previously manage holdings of unproductive (slow moving) and obsolete inventory, this is no longer a viable strategy and some items in the range must go.

Promotions – tactics such as off-market retail, and promotions are popular ways for retailers to reduce stock. They work well where speed is not a driver. But retailers do need to be aware of the pitfalls of this approach – firstly that shoppers invariably ‘cherry-pick’, and stores can be left with a mix of unsellable items. Secondly that off-market retail does risk cannibalising their existing market.

Secondary channels – for some retailers, the answer is to rapidly remove the unproductive stock from their business. With companies’ attitudes to waste and sustainability under increasing scrutiny, savvy category managers are recognising that wholesale buyers are an effective solution to solving several problems in one transaction.

Good stock turnaround equals healthy margins, which are critical to attracting investors or lenders. When companies are looking for capital to grow, the way in which inventory is managed makes a significant difference to the attitude of lenders and investors, and their propensity to offer funding.

Lenders are increasingly offering Asset Based Lending solutions to clients, using assets classes such as accounts receivable and inventory as collateral. The value of this collateral directly impacts the ability to lend. Lenders and investors will look at stock turns and levels of unproductive stock in determining the value and extend to which they are willing to transact.

The Valuations and Diligence Services team at Hilco Global recently encountered the impact of inventory in a recent engagement. They were providing a valuation on inventory as collateral to an asset based lend, and saw an uptick in stock holdings and a corresponding slump in stock turns. On further analysis, it became clear that this was a response to supply chain challenges, forcing the borrower to overorder on inventory to meet future seasonal demands. Compounding the situation, the levels of slow-moving stock had increased, affecting the overall value – and borrowing base – of the lend.

Unproductive stock is a millstone around a business’ neck. But converting it to cash enables a business to purchase new, more productive stock and fuel growth.

A large retailer whose clientele are primarily travellers, found themselves in this predicament. Border lockdowns and the subsequent massive reduction in international travellers left them with a large holding of inventory. They found themselves in a hog-tied situation – cash flow was needed to fund new stock purchases, but it was tied up in unproductive stock with stock turns up to 4 x lower on some lines.

They turned to Hilco Global, whose Salvage and Wholesale team reviewed their challenge and saw the immediate need to isolate the unproductive stock and rapidly remove it from the retail ecosystem. Hilco Global bought the entire stockholding, and within days had released a seven-figure cash sum. Michael Hayes, head of Hilco’s Salvage and Wholesale team that architected the solution said:

The retailer recognised that they needed a cash injection, and our team was able to meet the challenge and turn around a solution at record pace.

While it is widely accepted that holding onto unproductive or slow-moving stock is a cost of doing business, the levels of unproductive stock a company holds could have a direct impact on working capital, profitability, and future growth. Navigating out of this market environment requires absolute diligence and decisiveness in removing inventory that isn’t adding value.

If you’d like to learn more about how to manage your inventory smarter, balance your competing demands and eliminate unproductive stock, talk to the retail management team at Hilco Global.

Sources

https://www.rba.gov.au/publications/smp/2021/may/box-b-supply-chains-during-the-covid-19-pandemic.html

https://www.abs.gov.au/media-centre/media-releases/less-businesses-supply-disruptions

https://www.aigroup.com.au/globalassets/news/reports/2021/supply_chains_state_of_play_dec2021.pdf

Rochelle has forged a career as a Retail inventory specialist over 18 years across auctions, marketplaces, eCommerce and Retail, locally and internationally. Having worked for both high growth start-ups and Australia’s largest retail corporations, Rochelle has seen the myriad of challenges faced by Retailers in complex inventory environments.

As Director, Wholesale at Hilco Global, Rochelle translates this expertise in buying, sourcing and trading, offering clients strategies that can be deployed immediately in solving inventory challenges at scale.

Michael is a director and founding shareholder of Hilco APAC. With over 25 years experience, he is a go-to person in auction and salvage disposal.

Mike has continued to work hard for retailers and insurance professionals, having the ability to see possibility in even the most bespoke asset classes.

Michael saw a gap in the market to provide a truly global offering across valuation, advisory and monetisation, leading to the formation of Hilco Global APAC.